This article explores how hyper-personalization can become a powerful catalyst for engagement and revenue for banks during Black Friday. This period now mobilizes financial institutions, FinTechs, and benefits clubs in the US, all vying for the attention of an increasingly digital, demanding, and value-aware consumer. Definitely, Black Friday is no longer exclusive to retail.

In a market where everyone offers discounts and benefits, the differentiator is not how much is offered, but how and when the offer arrives. This is where hyper-personalization comes in: the strategy that transforms data into unique experiences and maximizes the value of every interaction.

The New Digital Competition Landscape

The consumer’s behavior has changed dramatically. In the financial sector, it’s now clear that merely offering credit or discounts is insufficient. Offers must arrive at the right moment and be so personalized that they provoke the feeling: “How did they know exactly what I needed?”

This context underscores the importance of hyper-personalization as an essential strategy to deliver value and relevance in every interaction, particularly during high-competition periods like Black Friday.

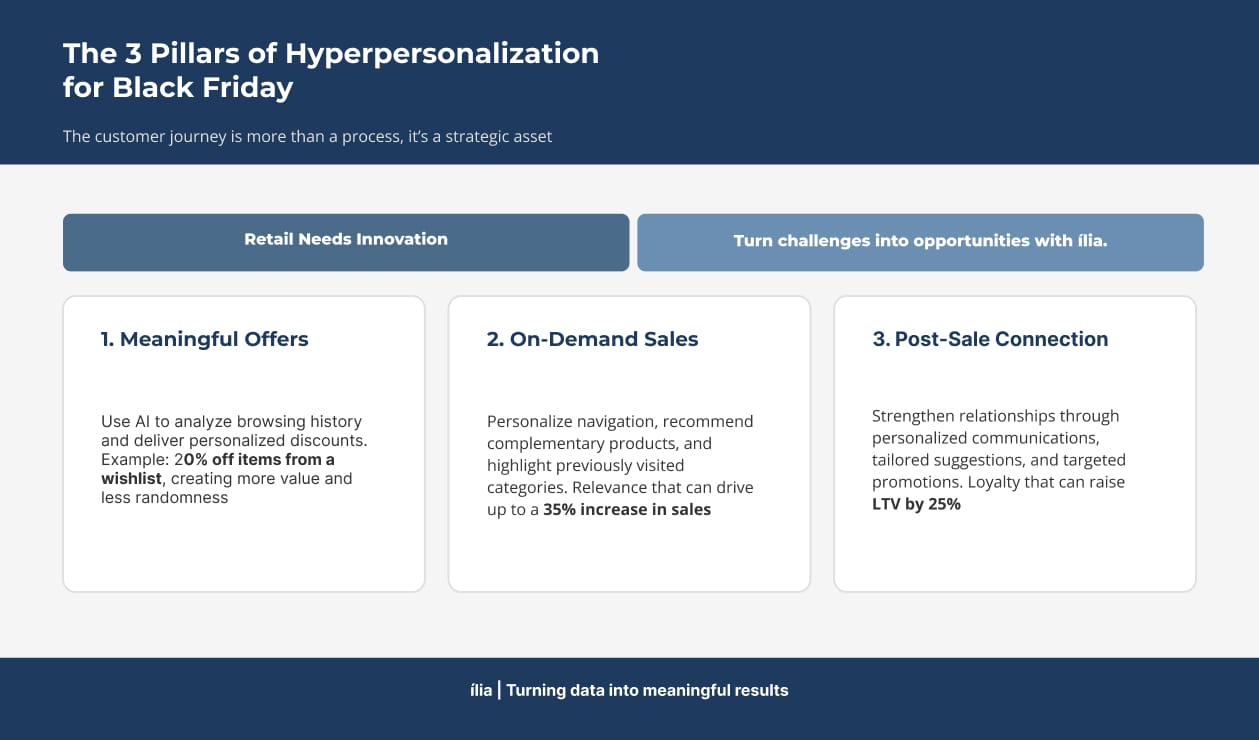

The Pillars of Hyper-Personalization for Black Friday in Banking

Hyper-personalization goes far beyond traditional segmentation, which was limited to basic variables, and surpasses the simple “Hello, [Customer Name].” It combines behavioral, contextual, and predictive data to create unique, real-time, and truly relevant experiences for each client.

In the financial sector, particularly for credit and rewards programs, it means transforming every interaction, whether a credit offer, a product recommendation, or a support request, into an opportunity to generate individualized value.

Three technical pillars sustain this purpose and ensure its effectiveness.

Connected and Contextual Data

The foundation is data unification. With a 360° customer view that integrates financial history, digital behavior, and past interactions, it becomes possible to create relevant, personalized recommendations, avoiding generic offers and delivering a truly unique experience.

Artificial Intelligence and Intelligent Automation

AI makes the process dynamic and scalable. Predictive and Machine Learning models analyze behavior patterns, anticipate needs, and adjust the journey in real time. This automation layer ensures fast and accurate responses, even during high-demand periods like Black Friday.

Omnichannel Orchestration

The experience must be continuous and coherent across every channel. Omnichannel orchestration, combining human and digital service, ensures the customer is recognized and understood at every touchpoint with consistency and empathy.

These pillars sustain the delivery of value and trust during Black Friday in banking, precisely when customers expect to be understood the most, at the moment they decide to purchase, invest, or seek support.

The Role of Security Beyond Data Privacy Regulations

While regulations like the CCPA (California Consumer Privacy Act) and emerging federal standards are crucial, security in hyper-personalization projects must go further.

Fraud mitigation is a critical aspect, supported by predictive AI technologies that identify and block scams in real-time, preserving financial institutions’ margins and credibility.

Reliable data architectures, offering security, resilience, and robust governance, form the bedrock for secure and scalable operations. This includes the efficient and integrated use of services, ensuring data is always ready for business-aligned applications with maximum protection.

How ília Builds Intelligent Experiences

ília is a strategic partner for the top cloud technology platforms in the financial sector: Salesforce, Genesys, and AWS. This technological synergy is essential for designing and orchestrating robust and scalable hyper-personalization solutions for the US market.

- Salesforce: Brings a powerful suite of cloud CRM tools, including the Financial Services Cloud. We leverage Salesforce Einstein (AI engine) for predictions and recommendations and MuleSoft for agile, secure API-first integration.

- Genesys Cloud: A global leader in Customer Experience (CX) and Contact Center as a Service (CCaaS). We use its omnichannel orchestration, intelligent routing, and conversational AI to create fluid and personalized journeys, supported by tools like the Smart Agent Workspace for real-time Next-Best Action.

- AWS: The cloud infrastructure provides the essential scalability, security, and performance. Key services utilized include Amazon S3 (Data Lakes), AWS Lake Formation (governance), Amazon SageMaker (ML model deployment), and Amazon Personalize (real-time recommendations).

This architecture ensures data is always “AI-ready,” enabling fast, precise, and secure decisions—indispensable during the banking Black Friday season.

Real Impact and Specialized Consulting

More than technology, hyper-personalization demands strategy and expertise.

With a consolidated presence in the financial sector, ília offers specialized consulting in:

- Secure and scalable cloud architectures.

- Fraud mitigation with predictive AI.

- Data governance and compliance.

- Creation of results-oriented omnichannel journeys.

This combination of technology, intelligence, and execution positions ília as the strategic partner for institutions seeking to master the customer journey—with relevance, efficiency, and security.

Transform Data into Value

Black Friday is the perfect moment to put hyper-personalization to the test.

Speak with our experts and discover how to transform every interaction into a real opportunity for growth and loyalty.