Financial Sector

Overview

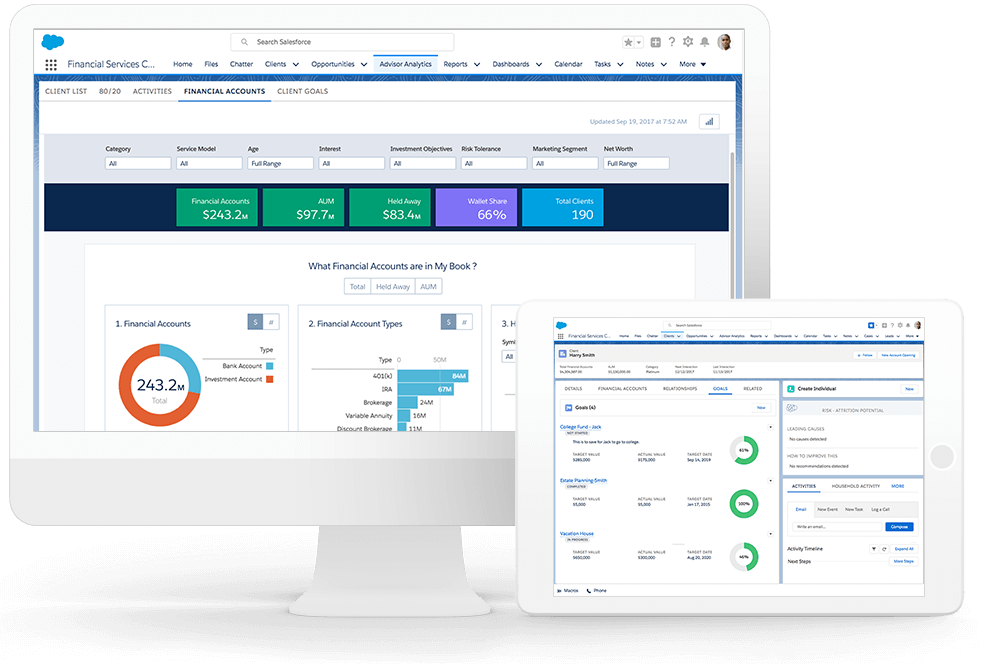

One of the largest digital financial services platforms in the world partnered with ília to transform its 100% digital investment advisory service. Using Salesforce Financial Services Cloud and CRM Analytics, we built an investment portfolio visualization model and a streamlined advisory workflow. The solution centralized client data, empowered advisors with real-time insights, and enabled managers to track performance. The result: higher client retention, improved efficiency, and over R$30 billion in assets under management.

Our challenge

For one of the largest digital financial services platforms in the world, Salesforce Financial Services Cloud proved to be a game-changer. This leading investment platform, part of Brazil’s top digital financial services group, was struggling with a challenge common to major players in the industry: decentralized operations and fragmented client data.

With ília’s expertise in the financial services market, we designed and implemented a Salesforce-powered solution with CRM Analytics to centralize portfolio data, streamline advisory workflows, and deliver a 360-degree view of every client.

The strategic goal was clear: enhance the 100% digital investment advisory service, giving advisors the ability to manage portfolios more effectively and provide personalized, data-driven guidance to investors.

The impact was immediate. By scaling operations within Salesforce, the fintech empowered its advisory team with greater access to real-time insights and client intelligence. Advisors could now deliver faster, more accurate, and client-focused service, reducing average call times, increasing the number of clients served, and significantly improving conversion rates and operational efficiency.

The journey

The engagement began with a Proof of Concept (POC), where ília demonstrated the capabilities of Financial Services Cloud and CRM Analytics, highlighting the operational gains and strategic visibility these tools could deliver.

Conducted by a small multidisciplinary team of three experts, the POC was completed in just three weeks, already showcasing tangible improvements.

During this phase, we ran a full product discovery process, gaining a deep understanding of the fintech’s most pressing challenges and mapping the deliverables that would create the highest impact.

We then designed a scalable architecture and advisory workflow, ensuring the solution could be implemented quickly and efficiently.

Once the configuration of Financial Services Cloud was aligned with the company’s methods of recording client and investment data, we migrated all client information and linked investment portfolios into the platform.

To streamline the advisory journey and enable a 360-degree client view, we applied omnichannel capabilities, eliminating the need to consult multiple systems and saving significant execution time.

Key steps included:

- Conducting product discovery to align the solution with strategic business needs.

- Migrating client and portfolio data for centralized, real-time visibility.

- Designing a scalable architecture to accelerate deliveries.

- Creating personalized dashboards that prioritized top accounts and high-value clients.

- Providing managers with real-time performance tracking tools.

The initial delivery included a partial migration of operations, followed by close monitoring of user behavior, tool adoption, and challenges faced during the adaptation period. Using feedback collected through Salesforce Surveys, we continuously refined the solution, enhancing usability and advisor efficiency.

Thanks to the clear ROI and immediate impact, the project quickly evolved beyond the POC. Within one month, the investment advisory service had scaled its use of Salesforce, and by the second month, the team was independently managing the entire operation on the platform – enriched with new integrations that elevated the overall client and advisor experience.

The result

In just one month, results exceeded expectations:

- Boosted advisor productivity: Reduced average call times while increasing the number of client interactions.

- Enhanced client retention: Personalized dashboards empowered advisors to deliver targeted, proactive support.

- Increased Assets Under Management (AuM): Strategic visibility and better portfolio tracking fueled steady growth.

- Comprehensive analytics: CRM Analytics delivered dynamic dashboards with insights into client segments, portfolios, and performance metrics.

- Scalable success: The advisory service now serves over two million clients with a portfolio surpassing R$30 billion in assets.

The adoption was so positive that the fintech rapidly scaled operations, achieving a considerable ROI while positioning itself for future innovation.